The Australian economy is in a unique position: a record number of Australians have a job, the stock market has just hit a fresh record high, and property prices are also at record highs in most locations, with the average value of a house up around 40% from start of the decade.

But our economy is in a ‘per-capita recession’. Households have seen disposable income take its largest hit since the 1991 recession, and consumer confidence is just recovering from near-record lows.

Our unemployment rate down at 4.1% is remarkably low by historical measures and there are almost twice as many job vacancies today as people actively look for work, but the reality of cost-of-living pressures is universal.

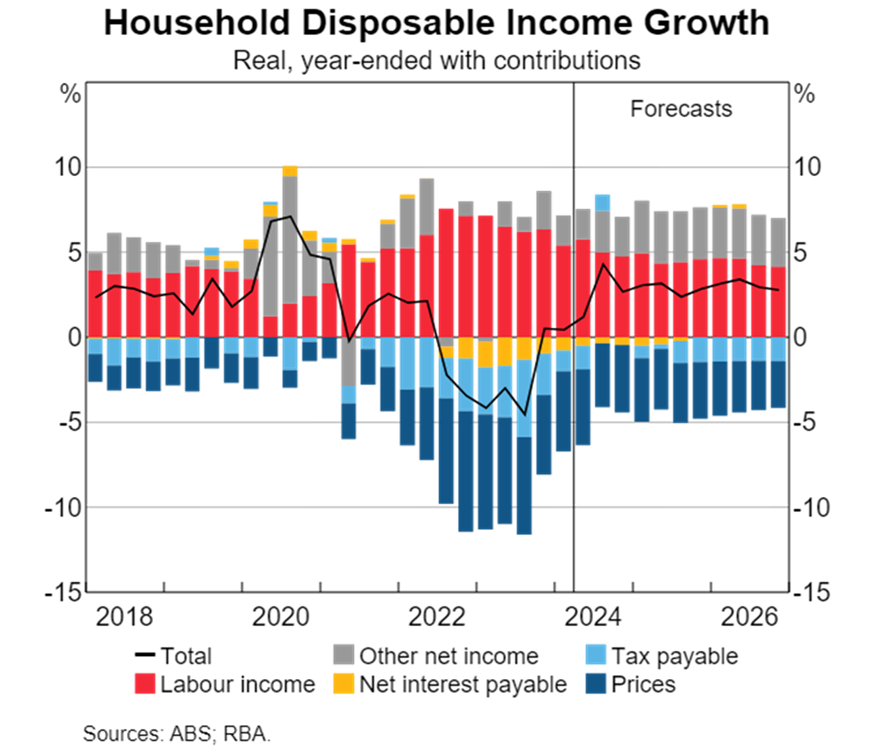

Fortunately, the worst appears to be behind us. As the following chart shows, inflation (higher prices) has been the core issue with cost-of-living pressures. With inflation moderating and the stage three tax cuts in place we should see incomes recovering in the next 18 months.

Inflation hasn’t been a major problem for Australian households for decades, so it was a huge, unexpected shock in 2022. Unfortunately, the only policy lever the RBA has to deal with it is higher interest rates.

Now that core inflation is back down to 3.5%, we are getting much closer to RBA rate cuts, which we still expect by May. By mid-2025, we should have the combined benefits of tax cuts, wages growing above prices, and falling interest rates.

It’s important to keep in mind that the core problem with cost-of-living has been inflation, so the solution lies in sustainably getting rid of it, which is why the RBA haven’t started cutting rates just yet.

Other central banks (in the US, New Zealand, Canada and the UK) took their rates above 5% versus our 4.35%, which is why their jobs markets declined more quickly than ours, and why they have all cut their rates at least twice.

By the end of 2025, we expect official interest rates in Australia will be back to ‘neutral’ at around 3.5% and underlying inflation will be back below 3%. The narrow path to a ‘soft landing’ is still navigable. Recent recessions in New Zealand, UK and parts of Europe are a reminder of how hard this is to achieve.

None of the local economic data or global events over the last month have indicated an imminent RBA rate cut, however, the third quarter inflation numbers confirmed that any further rate hikes appear most unlikely and that a series of cuts in 2025 remains on track.

Our forecasts have warned all year (and also in 2023) that rate cuts are likely to be a 2025 event and not earlier. Equally, we don’t expect any further rate rises as unemployment ticks higher towards 4.75% next year, and as economic growth remains below its long-term trend.

There are always risks to the outlook and most of them come from overseas (including trade wars and geopolitical tensions around the world) but Australia has a lot going for it:

- Our AAA credit rating means government can afford to invest in areas of priority;

- We are running a healthy trade surplus and the recent fall in the Aussie dollar is helping with export values;

- Our largest trade partner China has been adding stimulus to its economy (with more to come).

For households, the most important outcome in 2025 will be moving on from the cost-of-living shock; and should these forecasts all coincide then it will be good to have it in the rear-vision mirror.

If you’re interested in more regular Economic and market updates, you can watch our monthly Market update video or read our monthly Economic and market update on our Business banking hub page.

Written by David Robertson

Chief Economist, Head of Economic and Markets Research

Bendigo and Adelaide Bank Limited

25 November 2024

Any advice provided in this article is of a general nature only and does not take into account your personal needs, objectives and financial circumstances. You should assess with the help of legal, financial and taxation advice, whether it is appropriate for your situation before acting on it. Bendigo and Adelaide Bank Limited ABN 11 068 049 178 Australian Credit Licence 237879.