Make managing your business expenses easier and more rewarding with a Bendigo Bank Qantas Business Credit Card.

Earn 25,000 bonus Qantas Points1

Everyday business spend

Earn 0.6 Qantas points for every $1 spent on everyday business spend.#

Utilities and government spend

Earn 0.3 Qantas Points for every $1 spent on eligible utilities and government transactions#

Qantas products and services

Earn 1.6 Qantas Points for every $1 spent on selected Qantas products and services#

Discover the benefits of the Qantas Business Credit Card

With one of the lowest annual fees in the market, and a range of insurances, the Qantas Business Credit Card will help your points soar. Earn Qantas Points on your everyday business expenses and manage your expenses with a single monthly statement. Receive an itemised breakdown for each cardholder and flexible billing structures with a choice of who pays, how much and when.

Not a Qantas Business Rewards member? Join free to earn Qantas Points on everyday business purchases.

Features

Card controls

Stay in control with individual cardholder spending limits, optional ATM access to nominated cardholders and flexible liability arrangements.

Travel Insurance

Up to 3 consecutive months international travel insurance (for persons under 81)3

Warranty

Extended warranty on purchases made with your credit card for up to 1 year after the original manufacturer's warranty ends3.

Purchase protection

90 day purchase protection on stolen or accidentally damaged purchases when the total cost of the purchase is charged to your credit card3.

Points transfer

Transfer points earned to any individual Qantas Frequent Flyer account.

Security

Security - 24/7 fraud monitoring and no liability for unauthorised transactions.5

Rates and fees

Annual fee

$89 p.a.

Purchase interest rate

19.99% p.a.

Cash advance rate

21.99% p.a.

Interest free period

Up to 55 days4

Membership

Save 30% on Qantas Club memberships for you and your employees6

Additional card holders fee

$89 p.a. per card

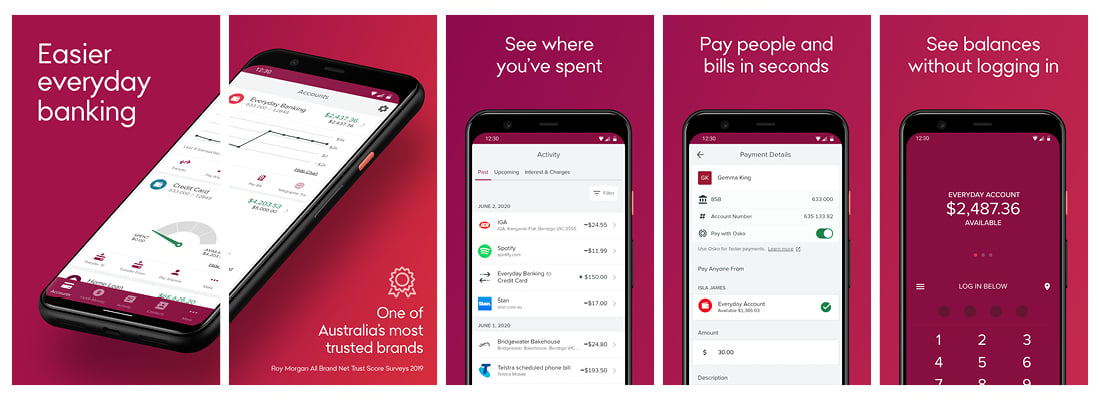

Business banking made easy - try the Bendigo Bank app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PAYID, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Safe and secure 24/7

Download the Bendigo Bank app now

Helpful tools

Need help?

Phone

Need support with your account.

At a branch

Use our branch locator to search for a branch near you.

Business hub

Our Business hub is designed to support your business with tips, tools, and resources to help your business succeed.

You may also be interested in

Things you should know

Terms, conditions, fees and charges apply. All information is correct as at 20/6/2019 and is subject to change. Full details available on application. Lending criteria apply. Interest rate and annual fee current at 20/06/2019. Rates and fees are subject to change. Credit provided by Bendigo and Adelaide Bank Limited ABN 11 068 049 178 Australian Credit Licence 237879.

1Bonus Qantas Points offer:

Offer is valid for applications submitted and approved from 12:01am AEDT 11 April 2022. Bendigo Bank may vary or end this offer at anytime and it is only available on the Qantas Business Credit Card.

25,000 bonus Qantas Points limited to one per Qantas Business Credit Card customer only. Minimum monthly repayments must be made as per your monthly statement and the account not otherwise in default.

To receive the 25,000 bonus Qantas Points, you must:

a) Register for free to be a member of Qantas Business Rewards https://www.qantas.com/au/en/business-rewards/partner/join.html?code=PFBENDIGO.

b) Apply and be approved for a Bendigo Bank Qantas Business Credit Card.

Bonus Qantas Points will be credited to your Qantas Business Rewards account within 90 days from account opening. Bonus Qantas Points will appear in your Qantas Business Rewards Activity Statement which can be checked online at qantasbusinessrewards.com/login.

#Qantas Points on everyday business expenses

A business must be a Qantas Business Rewards member to earn Qantas Points for business. A one-off join fee of $89.50 including GST normally applies, however this will be waived for Bendigo Bank customers upon approval of a new Qantas Business Credit Card facility. Membership and Qantas Points are subject to the Bendigo Business Standard Terms. Qantas Points are offered under Bendigo Business Standard Terms. Eligible Purchases are described in the Bendigo Bank Business Standard Terms and do not include fees, cash, cash equivalent transactions, balance transfers, premiums paid etc. and transactions for gambling or gaming purposes. You will also not earn Qantas Points on a card or card account where for that statement period, a card account is in arrears or over limit at the end of that statement period. See product page for more detailed information on Qantas Points earn rates. Earn rates are subject to change. Qantas Points are capped at 30,000 per statement period, or 360,000 per annum from the account opening date. Qantas Points will be credited to the Member’s Qantas Business Rewards Account within 60 days of the purchase of the eligible services. To use Qantas Points earned by your business, simply transfer them to any Qantas Frequent Flyer account. We recommend you consult your accountant or tax adviser to ensure you understand possible tax implications, for example fringe benefits tax (if applicable). You must be a Qantas Frequent Flyer member to earn and redeem Qantas Points. Membership and the earning and redemption of Qantas Points are subject to the Qantas Frequent Flyer program terms and conditions. A joining fee may apply. Any questions in relation to Qantas Points under this offer must be made directly to Bendigo Bank by calling 1300 236 344.

3Terms, conditions, exclusions, limits and applicable sub-limits apply. Refer to the Bendigo Credit Card Insurance (Qantas Business) Terms and Conditions for further information. Bendigo Bank does not guarantee any benefits under this insurance.

Complimentary insurance covers: AWP Australia Pty Ltd ABN 52 097 227 177 AFSL 245631 (trading as Allianz Global Assistance) under a binder from the insurer, Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz) has issued an insurance group policy to Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL and Australian credit licence 237879 (Bendigo Bank) which allows eligible Bendigo Bank account holders and cardholders to claim under it as third party beneficiaries. Access to the benefit of cover under the Credit Card Complimentary Insurance is provided to eligible Bendigo Bank cardholders by reason of the statutory operation of Section 48 of the Insurance Contracts Act 1984 (Cth). If an eligible person wishes to claim any of these benefits, they will be bound by the eligibility criteria, terms, conditions, exclusions, limits and applicable sub-limits contained in the Bendigo Credit Card Insurance (Bendigo Ready, Low Rate Platinum, Platinum Rewards and Qantas Platinum) Terms and Conditions which may be amended from time to time. Any advice on insurance is general advice only and not based on any consideration of your objectives, financial situation or needs.

5Mastercard Zero Liability: Conditions for protection apply, see mastercard.com.au/zero-liability

6Discounted Qantas Club membership is available to Qantas Frequent Flyer members who are Qantas Business Rewards Flyers of the Qantas Business Rewards Member. The discount applies to Qantas Club Individual membership rates and is managed under the Qantas Club Qantas Business Rewards scheme. Qantas Club membership is subject to the Qantas Club Terms and Conditions. Please be advised that lounges are subject to capacity limits at the time of your visit. If you're flying domestically on Qantas, QantasLink or Jetstar within Australia, and on Jetstar within New Zealand you may bring one guest to join you in a Qantas Club lounge. When visiting an international Qantas Club lounge, you are able to invite one guest each time you visit. Both you and your guest need to be travelling together further that day on the same flight. Lounge access eligibility conditions apply.

^ Roy Morgan Risk Monitor 2024. Customers of Bendigo and Adelaide Bank Limited.