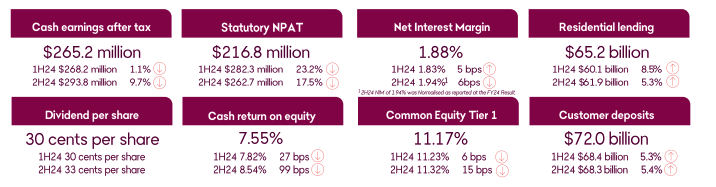

Bendigo and Adelaide Bank Limited (ASX:BEN) today reported cash earnings for the half of $265.2 million and statutory net profit after tax of $216.8 million. Cash earnings for the half were down 1.1% on the prior comparative period (pcp) and down 9.7% on the previous half.

Richard Fennell, CEO and Managing Director, said, “We have experienced significantly increased demand for both lending and deposit products from our customers, which has led to the strongest balance sheet growth we have experienced in some years. However, our earnings have been challenged both on the income and expense lines. Income was impacted by margin pressures, driven by higher funding costs to support accelerated lending growth. Expenses have also increased due to continued investment to deliver our transformation program.”

“We’ve improved our risk-based pricing capability to deliver stronger residential lending front book returns over the half, and we have now exceeded $100 billion in assets. We remain committed to disciplined investment as we continue to progress through our multi-year transformation program. This will allow us to achieve the scale necessary to compete effectively and deliver increased value to our shareholders.”

Operating expenses increased by 5%, impacted by increased investment spend and technology inflationary pressures, as we continue to invest in our transformation program. Our cost to income ratio increased over the half, up 430 basis points to 61.5%.

“Our balance sheet is well placed for the current economic outlook and future growth. The Bank’s Common Equity Tier 1 ratio of 11.17% remains unquestionably strong and well above the Board approved target. Over the half, we booked a net write-back in credit expenses of $10.5 million, reflecting the high-quality nature of our lending book,” Mr Fennell said.

Customer deposits grew 5.4% over the half, driven by strong growth in our EasySaver accounts (up 12.4%) and offset accounts (up 14%). Our household loan to deposit ratio of 73.2% was up 67 basis points over the half, remaining above the average of the four major banks and demonstrating the strength of our deposit-gathering capabilities.

Total lending grew 3.4% over the half with residential lending increasing 5.3% over the half, reflecting continued growth across all consumer channels. Our branches, including Community Banks, accounted for 30% of residential lending settlements, Bendigo Lending Platform accounted for 28% and digital mortgages accounted for 19% of all settled mortgages. Business and Agribusiness (B&A) lending contracted 3% over the last six months, mainly due to seasonal run-off in the Agribusiness portfolio late in the half.

Net Interest Margin was down 6 basis points over the half (from 1.94% on a normalised basis) to 1.88%, impacted by higher cost deposits and increased wholesale funding costs. Deposit mix was impacted by customers preferring to hold higher balances in their offset accounts and longer dated term deposits.

“Our customer numbers continue to grow strongly, up 4.9% over the half to 2.7 million customers, and Bendigo Bank’s Net Promoter Score of +22.0 remains 31.1 points above the industry average. Our customer numbers are growing at a rate faster than any other major or regional bank. Our innovative digital bank Up has passed the 1 million customer milestone after just six years of operation. Up’s customer numbers continue to grow as it delivers on customer expectations for quality products and a unique customer experience, reflected in its unrivalled Net Promoter Score of +58.4,” Mr Fennell said.

Gross impaired loans decreased 6.1% to $127.4 million, representing just 0.15% of gross loans. During the half, a net writeback of $10.5 million was booked, of which $9.9 million was in the collective provision reflecting a reduction in some overlays. In residential lending, 90-day plus arrears have increased by 9 basis points and remain at low levels for the Bank and well below industry averages. In B&A, 90-day plus arrears have decreased over the half, mainly due to a reduction in expired loans.

Total operating expenses increased by 5.0% for the half. We continue to manage our business-as-usual expenses prudently with operating expenses, excluding investment spend, contributing 3.8% growth. The increase in costs is due to a combination of wage inflation, new digital assets, higher amortisation charges, and the impact of price rises from existing technology vendors. Overall, productivity benefits of $6.2 million were realised during the half contributing a 1.1% reduction in our cost growth.

The Board has determined to pay a half year dividend of 30 cents, which is stable on pcp and reflects a 64.0% payout ratio based on cash earnings. The Board is committed to balancing the capital required to support strategic investments for future growth while delivering consistent returns to shareholders.

Transformation program update

We are nearing the final stages of a six-year transformation program. Over the half, we made strategic decisions to increase our investment spend that will support delivery of the transformation program in 2025. During the half, the transformation program focused on investment in our key growth engines that are reducing complexity across our systems and uplifting digital and risk management capabilities. This includes:

The successful roll-out of the Bendigo Lending Platform, which helped support home lending growth at twice the rate of system over the half. The platform will be rolled out to mobile lenders and to branches this calendar year.

Establishment of the Business Direct team within B&A, to improve customer experience for our micro business customers. Additionally, process improvements across B&A have seen a 16% reduction in key customer pain points. The migration of Rural Bank customers to Bendigo Bank Agribusiness will be completed in 2H25.

Up’s continued new customer growth, at 13.2% half on half. Deposits are up 22.6% to $2.6 billion, and home loans are up substantially to $1.2 billion. We will continue to invest in Up, driving growth across both sides of the balance sheet.

Outlook

“Despite ongoing cost-of-living challenges facing Australian households, we have seen our home loan customers increase their repayments over the half, with 42% now one year ahead on repayments and 86% maintaining a financial buffer,” Mr Fennell said.

“Australia remains in a strong position and is well placed to withstand periods of uncertainty or volatility. Recent data suggests a reduction in core inflation will be slow but remains on track1. We anticipate official interest rates to be reduced to a more neutral level of around 3.5% this calendar year. We are also mindful of the challenges facing the Victorian economy, specifically, where arrears are slightly higher than other states, though we note there has been no material impact on credit costs.”

“Looking ahead, we anticipate a more positive economic outlook and the prospect of interest rate reductions, in the face of easing inflation. Credit quality remains sound, however, we are monitoring our portfolio carefully and expect residential arrears to gradually increase and bad and doubtful debts to move toward longer-term averages.”

“Bendigo Bank operates the third largest branch network in Australia and the second largest regional branch network2. We are proud of our regional heritage and are committed to providing our products and services in locations where our customers value face-to-face banking. Our unique Community Bank model, which has returned over $366 million to communities since inception, supports this commitment and helps us deliver on our purpose to feed into the prosperity of our customers and communities.”

“The Bank’s commitment to delivering returns above the cost of capital over the medium-term is supported by the changing profile of its mortgage portfolio. The origination of lower Loan to Value Ratio home loans is reducing relative credit risk weighted asset exposure and is contributing to stronger new business returns. Our discipline on costs remains, targeting business-as-usual cost growth at no higher than inflation through the cycle.”

“We are committed to completing the final phase of our transformation program which will see us operating on one core banking system by the end of 2025. The investments we are making will sustain momentum. We will continue to invest in our growth engines, and we expect growth in mortgages to be above system. B&A is targeting a return to growth in FY26, and Up is targeting to maintain its current growth trajectory.”

“We’re building the Bendigo Bank of the future, and our foundations are strong, backed by our 166-year history. We continue to prioritise sustainable growth and productivity improvements as we scale the business for the benefit of our shareholders, our people and customers,” Mr Fennell said.

For more information visit our Financial Results page.