This clever transaction account is designed to help you earn while you learn. It's available to full time students, apprentices and trainees.

Three reasons to open a Student Account

For your student life

Eligible for full time students over 12, apprentices and trainees

Debit Mastercard®

Access your money with a Debit Mastercard® and enjoy 24/7 fraud monitoring

Security

Robust security features to keep you safe and secure against unauthorised transactions

Student Account summary

- Minimum opening balance of just $1

- e-banking and phone banking anywhere, anytime

- Branch and ATM access Australia wide

- Access your money with a Debit Mastercard®*

- Go green and set up e-statements on your account

- Earn tiered interest on your account balance

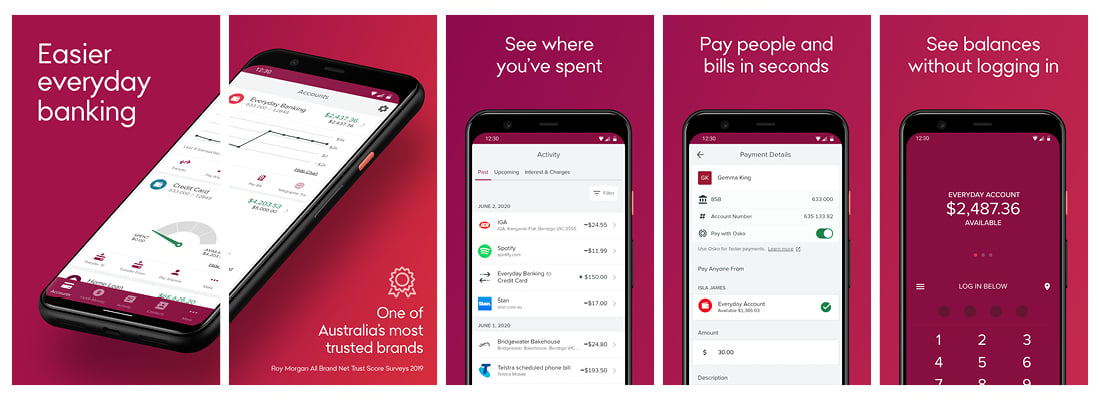

Student Account in your Bendigo app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PAYID, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Safe and secure 24/7

Download the Bendigo Bank app now

Rates and fees

Monthly service fees

$0

Branch & ATM

$0 - unlimited Bendigo Bank ATM withdrawals

$2.50 for in-branch staff assisted services including cash withdrawals and transfers

Withdrawals

$0 - unlimited EFTPOS withdrawals within Australia

Transactions

$0 - unlimited retail purchases within Australia

Transfers

$0 - unlimited e-banking transfers; BPAY®, Pay Anyone (including OSKO®) and phone banking transfers

Tiered interest rates

- 0.00% p.a. on balances $0 < $250

- 0.01% p.a. on balances $250 < $2,000

- 0.05% p.a. on balances $2,000 < $5,000

- 0.05% p.a. on balances $5,000 plus

Interest calculated daily and paid monthly.

Before you start

Identity

If you are a new customer, we will need to verify your identity via any two forms of IDs listed below:

- Driver's licence

- Passport

- Medicare card

Eligibility

- You need to be an Australian citizen or resident

- Be aged 12 years or above

- Be a full time student, apprentice or trainee

Open a Student Account

New customers

If you are a new customer you can apply online in minutes.

Existing customers

If you are an existing customer you can apply via e-banking.

Apply in-branch

If you are a new customer you can apply at your preferred branch.

Mobile payments

Helpful tools

Discover our library of helpful tools to manage your finances, set goals, and achieve more.

Frequently asked questions

No, the Student Account has no monthly service fee.

A $2.50 fee which is charged if you visit one of our branches and have one of our team transact on your account – e.g. withdrawing cash or transferring money. For a full list of fees please refer to the Schedule of Fees Charges and Transaction Account Rebates booklet.

You’ll need to be 12 years old before you can open a Student Account.

No, you must be studying full-time (in an Australian or overseas institution) or completing an apprenticeship or traineeship to be eligible for the Student Account. If your student ID doesn't specify full-time enrolment, please visit your nearest branch to discuss.

No, the student must be the titled member on the account. A Parent/Guardian may be added as a non-titled member on the account, with the Student’s permission.

Yes, there is no limit on the number of Student Accounts you can have. If you want to open more than one Student Account to manage your finances more efficiently, you’re more than welcome to.

Need help?

Online

Complete the online enquiry form to get contacted via your phone or email.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may be interested in

Things you should know

*Available to persons aged 16 years and over and Australian Citizens and permanent residents.

Target Market Determinations for products are available.

Mastercard and Priceless are registered trademarks and the circles design and Tap & Go are trademarks of Mastercard International Incorporated.

BPAY and OSKO® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.

This information does not take your personal objectives, financial situations or needs into account. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

Student Account

Easily manage your money every day