5 minute read

Pocket money for the long-term

Saving for your children’s future is a financial goal for many parents. From putting money away for their education, to lending a helping hand when their first car comes calling or even being able to contribute to a first home deposit, we want the best for our kids.

Whatever your goals are, they usually begin with a savings account. They’re easy to open and simple to use.

However, a savings account may not be the only option.

Thinking long-term

A long-term investment may be a suitable way to make your savings work harder for you and your children. A managed fund could be the answer.

A managed fund is a professionally managed investment portfolio. The investments of individual customers are pooled together with other customers. A team of professional investment managers invest the collective monies of the investors and in doing so, look to generate a return.

With just a low initial investment, regular contributions, and the reinvestment of distributions, a managed fund can assist in fulfilling your objectives. Over time, the power of compounding returns can really make a difference to your investment balance.

Pocket money could perform

Most kids love pocket money. But what if that allowance could take them even further than the local milk bar?

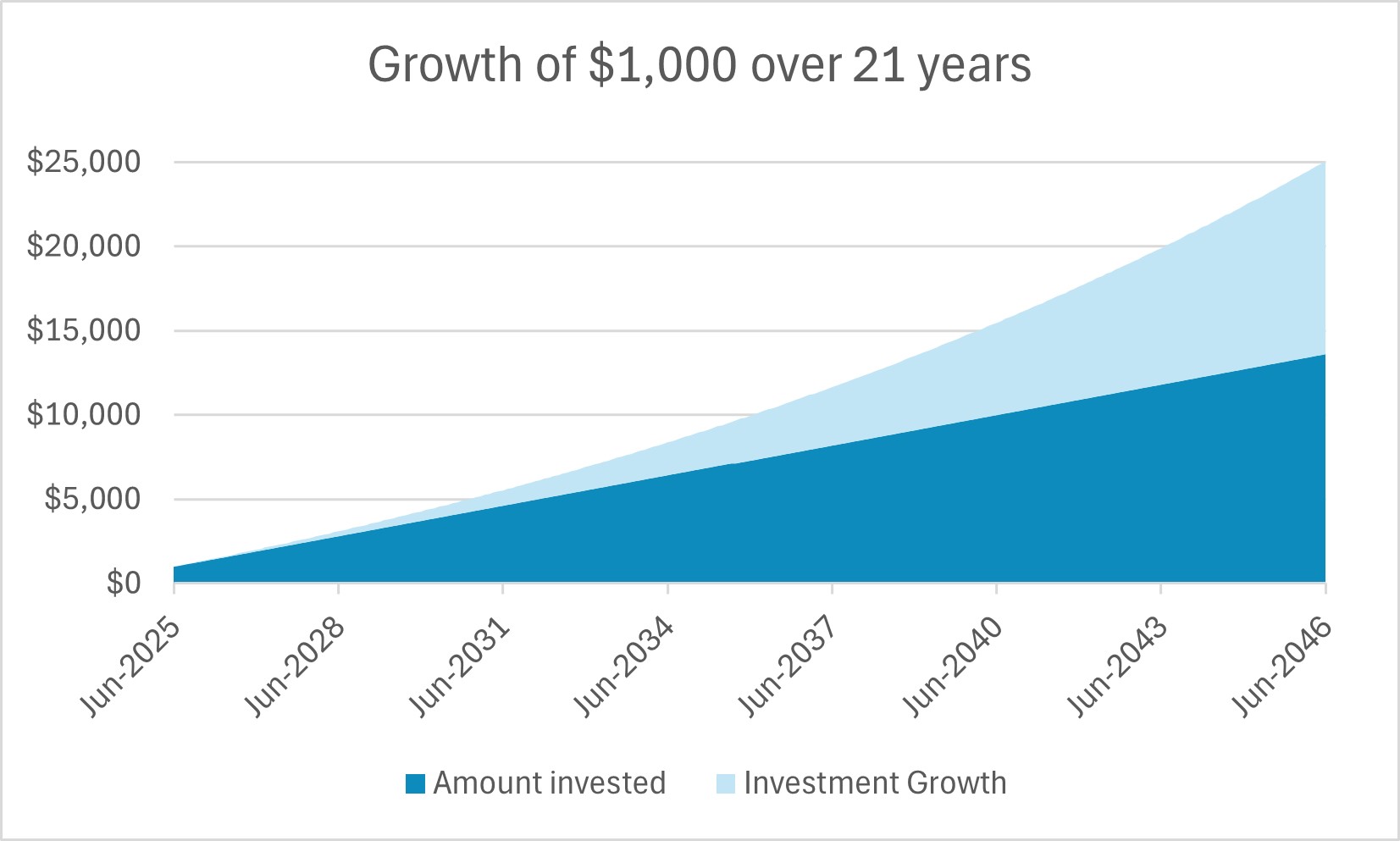

Starting with an initial $1,000 and regular contributions of $50 per month, over 21 years this could amount to $25,069 (this assumes a return of 5% p.a. and that you reinvest your distributions).

In this example, the amount you invested (plus initial deposit) would total $13,600 with an investment return of $11,469 (according to Moneysmart’s compound interest calculator).

Please note that this example is for illustration purposes only and is not an indication of actual returns.

How much does it cost to invest?

We have funds starting from a minimum entry amount of $1,000.

Let’s get started

We have a dedicated and experienced team to help you grow your children’s investment savings. Getting started is easy.

Head to your local Bendigo Bank branch and talk to one of our friendly staff members. Alternatively, we have a team of wealth specialists who can provide complimentary general advice. Complete this form and one of our team members can give you a call.

For more helpful information, check out our Education HUB.

Read next

Managed funds explained

What is a managed fund? And why are they growing in popularity? From unit prices to performance, and fees to diversification, we understand there's lots to know when it comes to managed funds. Fortunately, we're here to help you with the fundamentals.

Asset classes explained

Asset classes refer to the different categories that investments with similar features can be grouped into. Becoming familiar with asset classes can help you to further understand what to expect from the various investment options available to you.

Things you should know

Sandhurst Trustees

Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) is a wholly owned subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879. Sandhurst is the responsible entity and issuer of the managed funds available on this website. Additionally, Sandhurst is the issuer of commercial lending products and the provider of traditional trustee services available on this website. Each of these companies receives remuneration on the issue of the product or service they provide. Investments in these products are not deposits with, guaranteed by, or liabilities of Bendigo and Adelaide Bank nor any of its related entities, and are subject to normal investment risk, including possible delays in repayment and loss of income and capital invested.

Information on the website is jointly prepared by Sandhurst and Bendigo and Adelaide Bank and subject to change without notice. Advice in relation to managed funds and commercial lending products is provided by Sandhurst. The information contains general advice only and does not take into account your personal objectives, situation or needs. Before making an investment decision in relation to these products you should consider your situation and read the relevant Product Disclosure Statement available on this site.

The information is given in good faith and has been derived from sources believed to be accurate at its issue date. Neither Sandhurst nor the Bendigo and Adelaide Bank give any warranty for the reliability or accuracy or accept any responsibility arising in any way, including by reason of negligence for errors or omissions for the information contained on this website. Neither Sandhurst nor the Bendigo and Adelaide Bank has an obligation to update, modify or amend this website or notify you in the event that a matter of opinion or projection stated changes or subsequently becomes inaccurate.

Neither Sandhurst nor Bendigo and Adelaide Bank is responsible for the content of any other site accessed via this site. That information is the responsibility of the site owner. Links to other sites are provided for convenience only and do not represent any endorsement by Sandhurst or the Bendigo and Adelaide Bank of the products and services offered by the site owner.