Invest in a low-risk, diversified portfolio that provides regular income.

A Fund that strives for a higher level of return with a lower level of risk

The Strategic Income Fund (Fund) is designed to provide regular income and returns higher than traditional cash investments by strategically managing its portfolio in varying market and economic conditions.

The Managed Fund product/s referenced on this page are issued by our wholly owned subsidiary Sandhurst Trustees Limited.

Low initial investment $2000

Ability to add to your investment

Quarterly income distributions

How it works

The Fund aims to deliver income returns that outperform the Bloomberg AusBond Bank Bill Index (after fees) over any 2 year period by investing in a diversified portfolio of domestic interest bearing securities across a range of maturities.

The Fund offers more than one class of unit. The term used to describe this type of offering is called “multi-class pricing”. Both units are ranked equally on a return of capital basis and have the same investment portfolio.

Class A investors - $2,000 minimum investment (information on this page is relevant to class A investors)

Class B investors - $500,000 minimum investment. An investor who applies for units in the Fund through a platform is defined as a Platform Investor and is issued with Class B units. Sandhurst may, at its discretion, and when certain conditions are met, offer Direct Investors the opportunity to invest directly in Class B units. Further details of when this may occur can be found in the PDS.

Features

Regular savings plan available

Add to your investment at any time (min additional investment $500 or $50 per month via regular savings plan)

Access to a diversified portfolio and easy access to your funds

Fees and costs*

Management fees and costs

0.81% p.a. of the net asset value of the fund

Entry and exit fees

$0

Additional contribution fee

$0

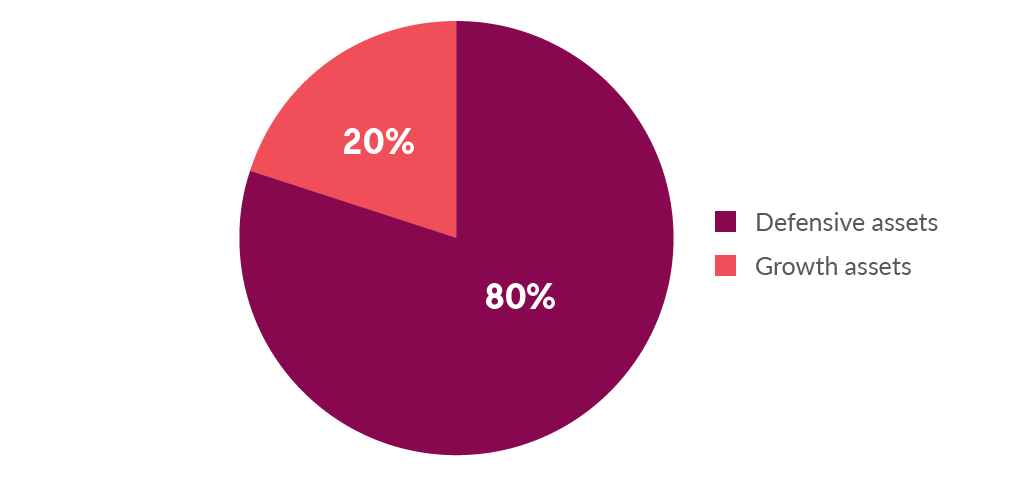

Defensive

To invest in this style, you would have a low tolerance for losses and risks which naturally leads you to give up on a larger return that comes with higher-risk investments. This investment style often looks to fixed income products such as cash, loan funds and bond funds. Usually at least 80% of this portfolio would be in defensive assets.

Risk profile

Low

Learn more about defensive investment style.

Ready to apply?

Move towards your goals. Apply online today.

Rating reports

Foresight Analytics

Foresight Analytics has assigned a SUPERIOR investment rating to the Fund with a product complexity indicator designating the Fund as a Relatively Simple Product. A rating of SUPERIOR implies the highest level of confidence that the Fund can deliver a risk adjusted return in line with its investment objectives. Designation as a Relatively Simple Product indicates that the investment manager will seek to outperform their chosen mainstream market sector. Foresight Analytics' opinion is that the investment managers' investment process is robust and benefits from the experienced management team^.

Read the investment rating report for further information.

Need help?

Enquire online

Send us an online enquiry if you have any questions.

Phone

Call us today between 8.30am to 5pm (AEST/AEDT)

At a branch

Use our branch locator to search for a branch near you.

Education HUB

Learn about topics that matter to you.

Things you should know

Target Market Determinations for products are available.

* Management costs are based on costs incurred by the Fund in the past financial year and may be different in the current and future financial years. Other fees and costs may apply. See the Product Disclosure Statement for full details.

^ A rating is not a recommendation to invest, retain or redeem units in the Fund. The rating may be subject to change or withdrawal at any time. A copy of Foresight Analytics' Financial Services Guide can be found at foresight-analytics.com/financial-services-guide.

Sandhurst Trustees

Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) is a wholly owned subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879. Sandhurst is the responsible entity and issuer of the managed funds available on this website. Additionally, Sandhurst is the issuer of commercial lending products and the provider of traditional trustee services available on this website. Each of these companies receives remuneration on the issue of the product or service they provide. Investments in these products are not deposits with, guaranteed by, or liabilities of Bendigo and Adelaide Bank nor any of its related entities, and are subject to normal investment risk, including possible delays in repayment and loss of income and capital invested.

Information on the website is jointly prepared by Sandhurst and Bendigo and Adelaide Bank and subject to change without notice. Advice in relation to managed funds and commercial lending products is provided by Sandhurst. The information contains general advice only and does not take into account your personal objectives, situation or needs. Before making an investment decision in relation to these products you should consider your situation and read the relevant Product Disclosure Statement available on this site.

The information is given in good faith and has been derived from sources believed to be accurate at its issue date. Neither Sandhurst nor the Bendigo and Adelaide Bank give any warranty for the reliability or accuracy or accept any responsibility arising in any way, including by reason of negligence for errors or omissions for the information contained on this website. Neither Sandhurst nor the Bendigo and Adelaide Bank has an obligation to update, modify or amend this website or notify you in the event that a matter of opinion or projection stated changes or subsequently becomes inaccurate.

Neither Sandhurst nor Bendigo and Adelaide Bank is responsible for the content of any other site accessed via this site. That information is the responsibility of the site owner. Links to other sites are provided for convenience only and do not represent any endorsement by Sandhurst or the Bendigo and Adelaide Bank of the products and services offered by the site owner.