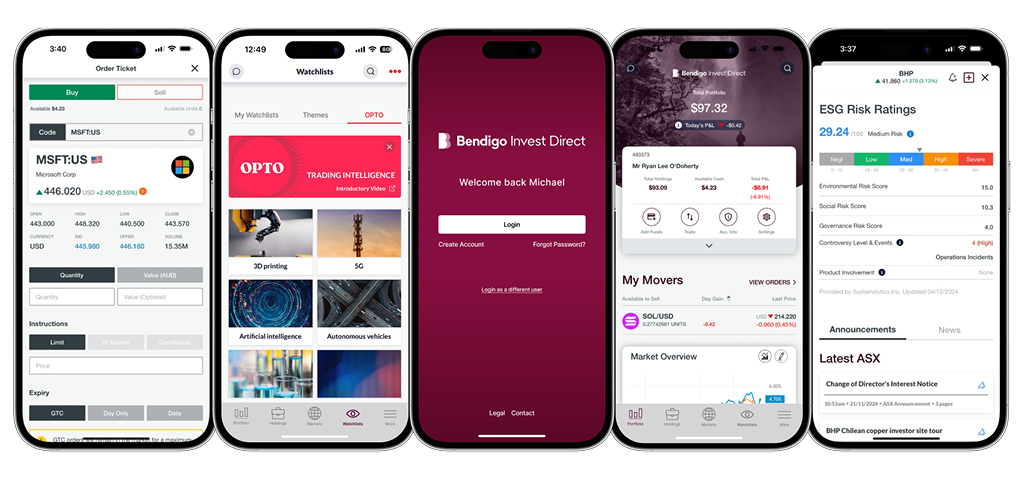

Join BID, download the app, and trade on the go. Bendigo Invest Direct - Share trading that's easy as.

Time to trade on the go

The BID mobile app gives you instant access wherever you are. Which means it’s easy to stay ahead of the market and make informed decisions faster. Plus, you can also:

- View your portfolio

- View live data

- Get up-to-the-minute info and the latest stock news

- Set and react to alerts

- Stay on top of your investment strategy

Simply download the app from either the App Store or Google Play.

How the BID app makes trading simple

Secure and easy accessibility

Add an extra layer of security with biometrics. If enabled on your phone there will be a prompt to set biometrics on your first login. You can also enable this feature at any time by tapping on the ‘More’ menu and then ‘Settings and Security’.

Multiple devices

We currently have a native BID mobile app for iOS and Android mobile operating systems. The BID mobile app can also be used on tablets.

All-in-one investment app

No additional apps needed. Trade Aussie shares, international shares, ETFs and more, all on the one app.

Manage your portfolio

Make the most of stock summaries, watchlists, ESG risk ratings and advanced order tickets to manage your portfolio.

Advanced charting

We have integrated TradingView’s advanced charts into our mobile and iPad apps. Choose from nine different chart types and over 100 technical indicators and drawing tools.

View and trade online

View and trade from your linked margin loan. You can view a summary of the loan, investments, collateral and available funds, as well as placing and amending orders.

All markets. One account.

Please note: International trading is not available to BID accounts that are funded by a margin loan.

| Australia | United States | ||

| United Kingdom | Hong Kong | ||

| Canada | Singapore | ||

| France | Netherlands | ||

| Belgium | Switzerland | ||

| Germany | Japan | ||

| New Zealand | Denmark | ||

| Spain | Sweden |

More reasons to trade

The Bendigo Invest Direct Frequent Trader program has three levels: classic, premium and platinum. Each has different complimentary benefits. You will automatically qualify for a level based on your trading activity.

Find out more with our Frequent Trader Program’s frequently asked questions.

How to get started with the BID app

Complete the online application form and sign up in minutes.

Get verified fast online and set up your BID account.

Download the app.

Start investing!

Frequently asked questions

Still have questions? We've answered the most common ones to help you navigate the BID app with ease.

For Apple devices we support iOS 15.6 and above. For Android devices, the minimum OS version is 7.0 and above.

If enabled on your phone, there will be a prompt to set biometrics on your first login. You can also enable this feature at any time by tapping on the ‘More’ menu and then ‘Settings and Security’. Experiences may differ depending on your mobile operating system.

You must not enable fingerprint or Face ID login where another person’s fingerprints/Face ID are registered on your mobile device. This is because they will be able to access your trading account, and you will be responsible if they place any orders using the app. You can turn this feature off at any time via ‘Settings and Security’.

You can manage your Dynamic (automatic refresh)/Live (click to refresh) data settings via the web platform. Once setup, your preference will automatically flow through to your mobile app.

Yes. Full market depth is available on the mobile stock summary pages for ASX stocks and within the order ticket. Data refresh rate depends on the market data package you have chosen, i.e. Dynamic, or Click to Refresh.

Yes. You can login to your desktop and mobile app at the same time.

Dedicated customer support

Online

Complete the online enquiry form and our team will be in touch.

Phone

Our dedicated customer support team are here to help.

Things you should know

*Online trades only. Other fees are involved when trading international shares. Brokerage rates apply to trades outside the selected markets. Refer to the full list of brokerage rates for more information.

Bendigo Invest Direct is a service provided by CMC Markets Stockbroking Limited ABN 69 081 002 851 AFSL No. 246381 (“CMC Markets Stockbroking”), a Participant of the ASX Group (Australian Securities Exchange), SSX (Sydney Stock Exchange) and Cboe (previously known as Chi-X) at the request of Bendigo and Adelaide Bank Ltd (ABN 11 068 049 178, AFSL 237879) (“Bendigo"). For a copy of the terms and conditions relating to the Bendigo Invest Direct services and the Financial Services Guides for CMC Markets Stockbroking or Bendigo (or other relevant disclosure documents), contact us on 1300 788 982, visit trading.bendigoinvestdirect.com.au/forms- external site or via email at info@bendigoinvestdirect.com.au. Neither CMC Markets Stockbroking nor Bendigo are representatives of each other. To the extent permitted by law, Bendigo will not guarantee or otherwise support CMC Markets Stockbroking’s obligations under the contracts or agreement connected with Bendigo Invest Direct.

Information is general advice only and doesn't take into account your personal objectives, financial situation, or needs. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses.

The Leveraged Equities Margin Loan, Investment Funds Multiplier and Direct Investment Loan are issued by Leveraged Equities Limited (ABN 26 051 629 282, AFSL 360118) ("Lender") as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879) ("Bendigo"). The Lender and Bendigo receive remuneration on the issue of the product or service they provide. Investments in this product are not deposits with, guaranteed by, or liabilities of Bendigo nor any of its related entities.