Earn interest on your savings with easy access.

Three reasons to open an EasySaver Account

Savings simplified

No introductory offers. No catch. Just a straightforward variable savings rate

Attractive ongoing interest rate

Ongoing variable interest rate of 2.80% p.a.

No monthly service fee

Watch your savings grow without worrying about monthly service fees

Sit back, relax, and watch those savings grow - no catch, no monthly service fees

Account summary

- e-banking and phone banking anywhere, anytime

- Branch access Australia wide

- No card access but transact online via e-banking or the Bendigo Bank app, through phone banking or at any branch

- Go green and set up e-statements on your account

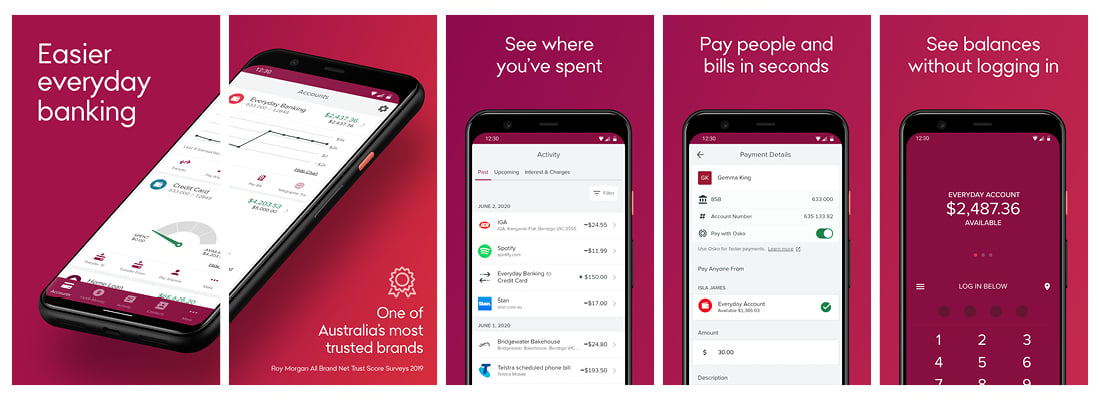

Banking made easy - try the Bendigo Bank app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PayID®, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Safe and secure 24/7

Download the Bendigo Bank app now:

Rates and fees

Monthly service fees

$0

Branch

2 free branch withdrawals per month

Transactions

$0 - unlimited free transactions via e-banking or the Bendigo Bank app

Interest rate

Current variable interest rate is 2.80% p.a.

Interest calculated daily and paid monthly.

Before you start

Identity

If you are a new customer, to sign up via the app you need to have one of the following forms of identification available:

- Australian Driver's licence

- Australian Passport

Eligibility

You need to be an Australian citizen or resident in order to apply for an EasySaver Account.

Joint or business accounts?

Please visit a branch if you are a joint or a business account holder.

Open an EasySaver Account via the app

Open our convenient no catch savings account in minutes.

I am an existing customer

- Log in online or the Bendigo Bank app

- Select 'Add a new account'

- Follow the simple steps to open your EasySaver Account

If you’d like more information you can go to your local branch or contact us on 1300 236 344.

Helpful tools

Discover our library of helpful tools to manage your savings, set goals, and achieve more.

Frequently asked questions

No, but you get free e-banking transactions so you can transfer funds to your transaction account that has a debit card.

All e-banking & phone transactions are free, plus you get two free in branch withdrawals per month. If you make more than two in branch withdrawals in a month you will be charged a fee. Please refer to the Schedule of Fees, Charges and Transaction Account Rebates.

Yes, there is no limit to the number of EasySaver Accounts you can have.

Simply have any amount in the account and you’ll start earning interest. There is nothing else you need to do.

Need help?

Online resources

We’ve got contact information and helpful resources to help you find the answers you need.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may also be interested in

Things you should know

*In branch withdrawals will accrue during the month and be charged to your account on the first day of the following month. A maximum of 2 in branch transactions will be rebated to your account at this time. All other transactions will incur a fee at the time of the transaction.

Target Market Determinations for products are available.

This information does not take your personal objectives, financial situations or needs into account. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

PayID® is a registered trademark of NPP Australia Limited.

EasySaver Account

Easy access to your savings