Our convenient transaction account with $0 monthly service fee lets you easily manage your money.

Three reasons to open an Everyday Account

$0 monthly service fee

An all in one transaction account with no monthly service fee designed to help you manage your money

Debit Mastercard®

Access your money with a Debit Mastercard® and enjoy 24/7 fraud monitoring

Security

Peace of mind with Multi-factor authentication (MFA) and protecting your card against unauthorised transactions

Everyday Account summary

- Minimum opening balance of just $1

- e-banking and phone banking anywhere, anytime

- Branch and ATM access Australia wide

- Access your money with a Debit Mastercard®*

- Go green and set up e-statements on your account

- Link to your Bendigo home loan to offset your monthly interest

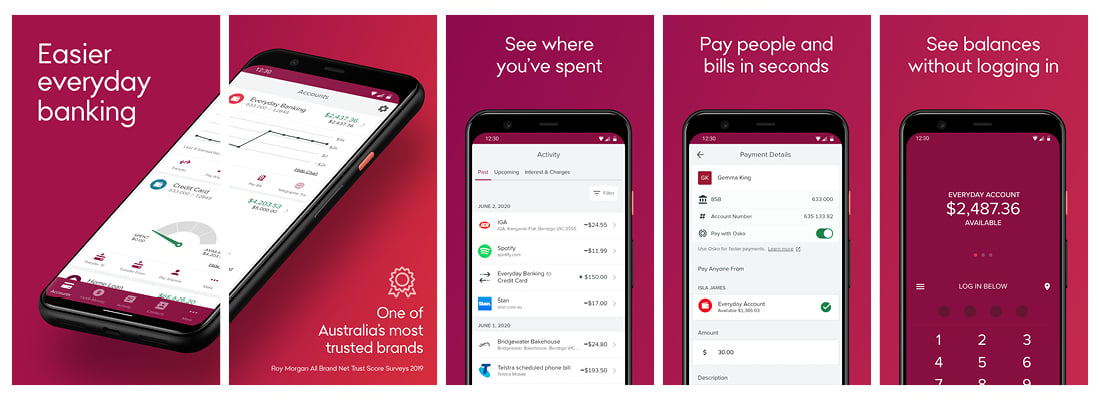

Discover the Bendigo Bank app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PAYID, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Robust security features to keep you safe and secure

Download the Bendigo Bank app now

Rates and fees

Monthly service fees

$0 - no monthly service fees

Branch & ATM

$0 - unlimited Bendigo Bank ATM and withdrawals

$2.50 for in-branch staff assisted services including cash withdrawals and transfers

Withdrawals

$0 - unlimited EFTPOS withdrawals within Australia

Transactions

$0 - unlimited retail purchases within Australia

Transfers

$0 - unlimited e-banking transfers; BPAY®, Pay Anyone (including OSKO®) and phone banking transfers

Interest rate

Current interest rate is 0.00% p.a. Interest calculated daily and credited half yearly

Before you start

Identity

If you are a new customer, we will need to verify your identity via any two forms of IDs listed below.

- Drivers License

- Passport

- Medicare card

Eligibility

You need to be an Australian citizen or resident in order to apply for an Everyday Account

Joint or Business accounts?

Please visit a branch if you are a Joint or a Business account holder

Open an Everyday Account

New customers

If you are a new customer you can apply online in minutes.

Existing customers

If you are an existing customer you can apply via e-banking or the Bendigo Bank app.

Apply in-branch

If you are a new customer you can apply at your preferred branch.

Debit card designs

Helpful tools

Discover our library of helpful tools to manage your finances, set goals, and achieve more.

Frequently asked questions

No, there is no monthly service fee.

A $2.50 fee which is charged if you visit one of our branches and have one of our team transact on your account – e.g. withdrawing cash or transferring money. For a full list of fees please refer to the Schedule of Fees Charges and Transaction Account Rebates booklet.

Yes, standard international fees apply to the Bendigo Everyday Account. These fees will be charged when you use your Debit Mastercard to make purchases overseas or online with businesses who are based overseas. For a full list of fees please refer to the Schedule of Fees Charges and Transaction Account Rebates booklet. If you're planning to travel overseas you may be interested in our Cash Passport.TM

Yes, you can have multiple Everyday Accounts.

Yes, you can choose to link a Debit Mastercard to your Everyday Account at no charge. A Debit Mastercard gives you the benefit of being able to make purchases online, use tap and go facilities, use mobile payments, use the card overseas and be protected from unauthorised transactions by Mastercard Zero Liability5. For fees associated with overseas transactions refer to the Schedule of Fees & Charges and Transaction Account Rebates.

Yes the Everyday Account can be opened for an individual or in joint names. To open a joint account you will need to make an appointment with your local branch.

Yes, customers can add an offset facility to their Everyday Account. Once the Everyday Account is linked to an active home loan the account name will automatically change to Everyday Account (Offset)

Need help?

Online

Complete the online enquiry form to get contacted via your phone or email.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may also be interested in

Things you should know

*Available to persons aged 16 years and over and Australian Citizens and permanent residents.

5Mastercard Zero Liability

Conditions for protection apply, see mastercard.com.au/zero-liability

#If you hold a home loan the fee will be waived each month provided the home loan is in use at least 2 days prior to the date the fee is charged.

Target Market Determinations for products are available.

Mastercard trademark

BPAY and OSKO® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.

This information does not take your personal objectives, financial situations or needs into account. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

Everyday Account

Easily manage your money everyday